Your Financial Timeline:

How Much is Enough?

What if you could afford to retire right now?

Would you?

- Or would you rather keep working? Or cut back, go part time, do some consultancy or undertake voluntary work?

- How much do you need to provide for your lifestyle?

- What if someone came in and offered to buy your business?

Wouldn’t it be great to know ‘how much is enough?’ to do what you (and your family) want to do, when you want to do it, for as long as you want to do it for.

One of our major goals in financial planning for clients is to ensure ‘the right money, in the right place, at the right time’

‘Your Financial Timeline’ helps us to do that for you.

This process will help you identify how much money you need to accumulate to reach your definition of financial independence. It is an ongoing service designed to ensure that you can always enjoy the lifestyle you choose to lead, without ever having the worry of running out of funds. You are able to look into your financial future so you can understand what actions you may need to take now to achieve your desired lifestyle.

We could generate an 80 page report with a plethora of charts. We could waffle on for pages about your finances. We could buy a computer program that churned out identical paragraphs for everyone.

We aim to bring SIMPLICITY to managing your finances and we do it personally, just for you.

First we create your timeline together.

It’s flexible, so we can add, amend and adjust as needed as the years pass

There is a certain amount of ‘number crunching’ to do. That’s why we have the computers! It means you and I can focus on the elements important to you , your family and your goals.

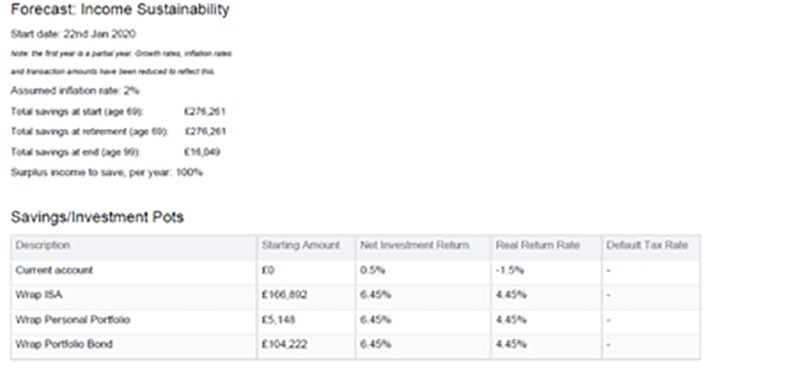

The planning takes into account both capital and income.

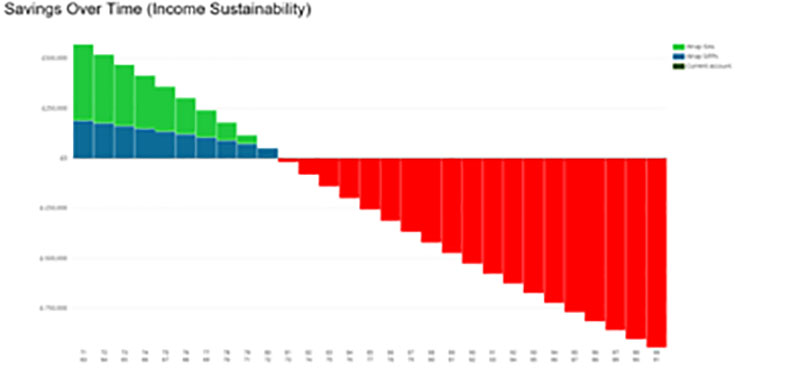

If there is any (red) shortfall, we’ll work out a way to address that.

We’ll look at what you have in place and how that could be improved. We’ll suggest adjustments, amendments or additions as appropriate.

The aim is to make sure your money doesn’t run out before you do!

And we can provide an ongoing service to ensure your plan remains fit for purpose as the years pass.

Key Features of ‘Your Financial Timeline’ include:

- How to avoid the three biggest risks in retirement

- Making sure you avoid taking on too much investment risk on money you may need in the future

- We build a timeline with you showing the type and frequency of income and expenses you have now and forsee / desire for the future.

- We adjust variables to reflect your lifestyle and your thoughts on items such as life expectancy, inflation and investment returns. And we’ll always give our input on these numbers if you want it.

- A formula for calculating if you’ll have a deficit and if so, how to address or prevent it.

- We can break out further figures over a year by year basis if you like the detail.

- We’ll make sure that you have certainty of income, now and later, no matter what happens with markets and investments

- Easy to understand results

- Important figures ‘at a glance’

- Your personal cashflow forecast, so you can see ‘How much is enough?’

And if anything needs adjusting from where you are now, we can then move on with putting plans in place to make sure you and your family have:

‘The Right Money, in The Right Place, at The Right Time’